How to measure brand awareness for your business

Understanding how to measure brand awareness is a critical part of building a successful sales process. The logic is inescapable: you have to be known before somebody can choose to buy from you. From that starting point, it’s a short step to recognise that if more people are aware of you, more people can buy from you.

But how do you find out your level of brand awareness? How do you know if you’ve got an awareness problem? There’s a simple way to find out. The answer is to do a bit of research. Yes, we go on about research endlessly but there’s no apology for that because it’s the most important and, simultaneously, the most ignored part of good marketing.

Step 1: Unaided brand awareness.

The first question you ask purchasers in your target market is very simple:

“When you’re thinking about {your product or service}, which brands come to mind?”

The first brand the purchaser mentions is known as “top of mind”. Any other brands she mentions are said to have “unaided awareness”.

If your company is not mentioned in response to this first question, your sales efforts are already on the back foot. Even if you have fantastic search optimisation that throws your name in the face of anybody searching for your product or service, even if you have a massive digital advertising campaign that does the same thing, you’ll struggle to overcome the major obstacle that is human behaviour: we’re lazy thinkers.

Binet & Field’s “The Long & Short of It” and Byron Sharp’s “How Brands Grow” both draw on research by Nobel prize-winner Daniel Kahneman who found that we tend to go for a choice that’s easiest for us. That usually means the most familiar choice.

So we almost always go for the brand names we recognise first. We only go to the effort of investigating new alternatives if the options we already know are inadequate in some way.

You’ve probably already realised that this first step in how to measure brand awareness has a small problem: you can’t ask the “when you think about…” question yourself. If you ask purchasers which brands come to mind, they’re bound to mention your brand. You’re sitting there right in front of them (or at least on the other end of a phone call or email exchange). That’s going to skew the results. This is one of the very few instances where there is no DIY route. You’ve got to get somebody else to ask these questions for you.

Step 2: aided brand awareness.

The second question is a logical extension of the first. You (or the company doing the research for you) asks:

“Irrespective of your previous answer, how many of the following brands are you aware of?”

And then you cite a string of your closest competitors.

This is known as “aided awareness”. You’ve got to admire the way marketers come up with these brilliant names, haven’t you?

Step 3: report on your brand awareness level.

If you’re plugging all your answers into a survey tool, the calculations are going to be done for you. We use Zoho Survey but you could get the same results with Survey Monkey or one of hundreds of other survey tools.

You’ll end up with four very important brand awareness metrics:

- Your level of top-of-mind.

- Your level of unaided awareness.

- Your level of aided awareness.

- Your level of non-awareness.

Step 4: let brand awareness put focus on your real problems.

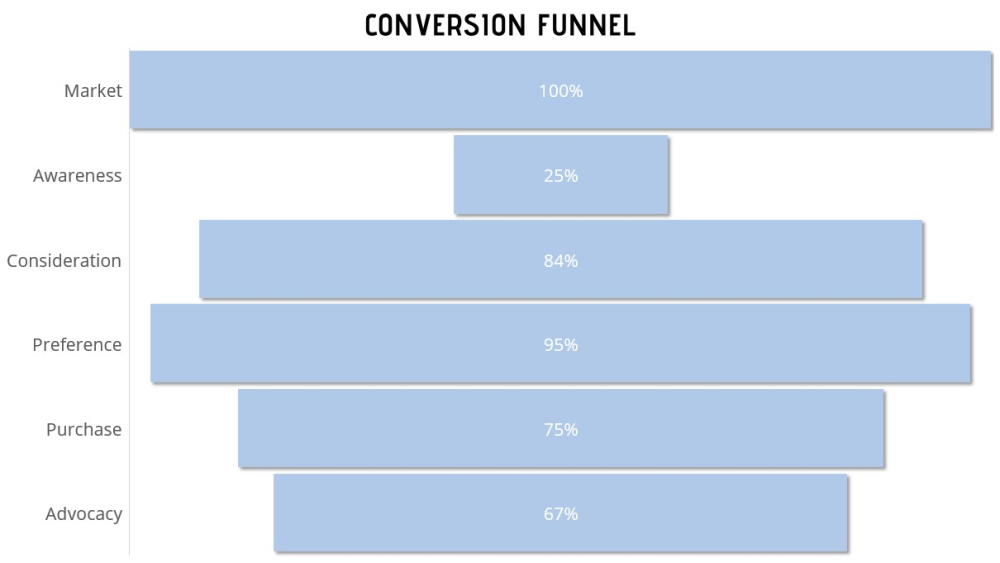

If your research showed that when you add up unaided and aided awareness your total awareness is still only 25%, you could produce a purchase funnel look something like this:

This is a great way of highlighting your problems in a visual way anybody can understand. It’s easy to see your least successful stage in this fictional purchase funnel. It’s the one with the smallest conversion rate from the step above: awareness. Armed with your research, you can say with certainty that only 25% of that market know who you are. So with the best sales people in the world, only 25% of the market could possibly become your customers.

The implications are critical. In this fictional example, the research tells you that your focus has to be on increasing awareness.

- You’re really good persuading people who are aware of you to consider you as a supplier (84%) – this might be considered the ‘long list’ stage.

- You’re even better persuading those people to make you their preferred choice (95%) – this might be considered the ‘shortlist’ stage.

- And most businesses would envy the rate at which you persuade people who put you on their shortlist to actually buy from you (75%). It’s clear that your focus doesn’t have to be on persuading people that your product is either good or better than your competitors. You’ve got that nailed.

- The problem is that most of the time you’re not even in that consideration. Only a quarter of the market knows who you are so only a quarter of the market compares you to a competitor.

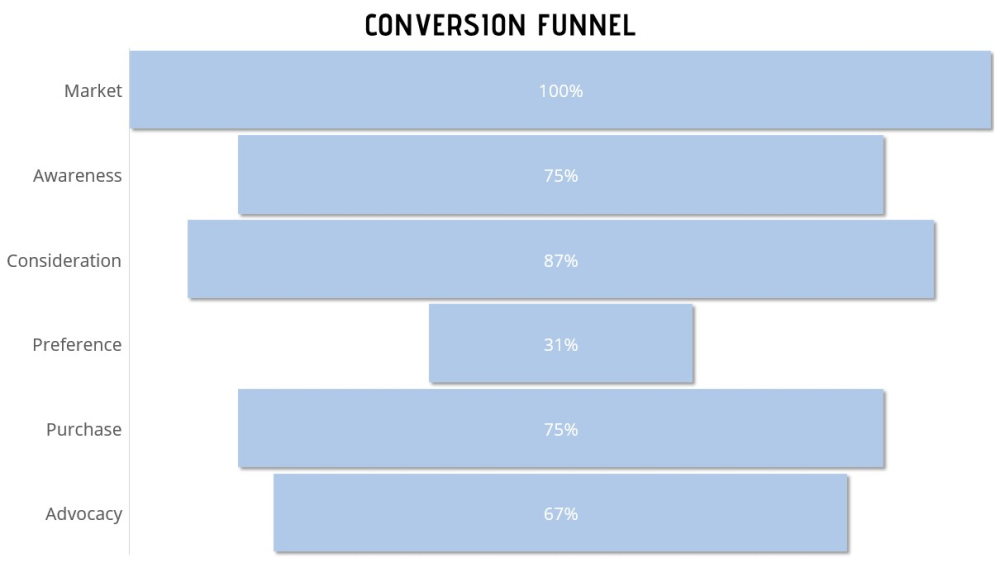

Alternatively, your brand awareness research might show a far more optimistic picture. It might help you produce a purchase funnel that looks like this:

If 75% of purchasers are aware of you, you should probably focus on other steps in the purchase funnel. In this fictional example, you’re successful at getting to the consideration stage (‘the long list’), but unsuccessful at getting through the preference stage (‘the shortlist’). That would be a better place to focus your efforts.

Step 5: add brand attributes to brand awareness.

This is an optional – but very valuable – step. Let’s assume you’ve already done enough research to know which attributes are sought-after by your customers. Imagine you make bricks and you’ve discovered that valued attributes are value, speed of delivery, range size and exclusivity.

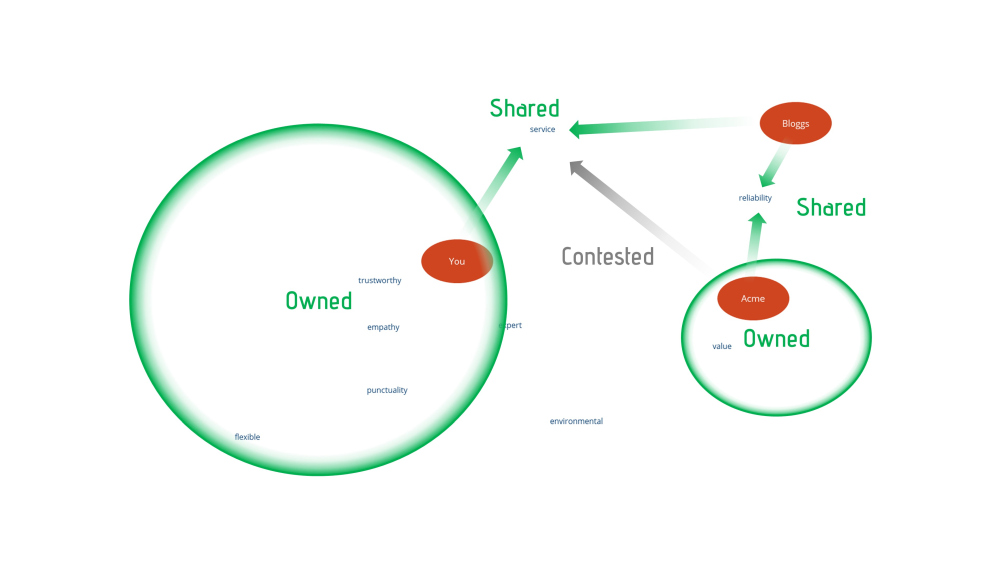

Armed with that knowledge, it can be tremendously useful to find out how strongly purchasers associate each of those attributes with each of the brands they recognise. This would let you develop a 3D perceptual map that tells you how you compare to your competitors for the attributes that matter to purchasers. It shows you your reputation with them as well as their awareness of you:

Knowing how to measure brand awareness becomes even more useful if you also measure brand attributes.

The mechanism for gathering this information is relatively straightforward if you’re using a survey tool. Set up a page in the survey for each of your competitors, asking purchasers how they’d rank that competitor for each of the attributes. Ranking on a scale of 1 to 5 is usually fine.

So, in our brick producer example, you’d have one page for Acme Bricks that asked how they were rated for value, speed of delivery, range size and exclusivity. And you’d have a very similar page for Dedicated Bricks, and another for each of your other competitors.

Then you set up your survey tool so that it only asks about competitors the customer is aware of. This kind of conditional question is a pretty standard feature for most modern survey tools.

Step 6: brand tracking.

Knowing your level of brand awareness is useful from the instant you get your results but it becomes even more useful if you repeat the exercise every year. This is called brand tracking. It often becomes an important KPI for a marketing department because it delivers a specific metric. You’ll find that almost all successful businesses do it. If they’ve got a problem with awareness it tells them how successfully they’re dealing with that problem. If they haven’t got a problem, it confirms that they can focus their efforts elsewhere.

Brand awareness, salience and mental availability.

If you’ve paid even the slightest attention to marketing trends over the last few years there will have been a couple of phrases bubbling up in your mind as you read this piece. One would be “mental availability”. The other would be “salience”.

Is brand awareness the same as salience and mental availability? There are two answers to that question and if you’ve seen our video about salience you’ll probably know what they are. If you’re a marketing professor or a marketer who is trying to impress other marketers, then brand awareness is not the same as salience or mental availability. There is a distinction.

But we’re not going to go into that distinction for a very good reason. If you’re a normal person or, God forbid, a normal marketer working for a normal company the terms are interchangeable. The distinction doesn’t matter.

Next steps.

- The DIY route. If you want to measure brand awareness yourself, you need…

- …to think again. You can’t. If you ask the questions, the person you’re talking to will inevitably be aware of your brand. You’ve got to have somebody else do it. If you work in the B2B sector, you be glad to hear that this is not the massively expensive endeavour that it is for B2C organisations. Your potential market is much smaller. If you make bricks, there are only a certain number of construction companies and builders merchants who might want to buy them. You don’t need to contact so many people to get a representative sample. It’s one of the few times B2B has an advantage over B2C.

- The Assisted route. This kind of activity is what Forbes Baxter Associates is here for. Give us a call. We’re surprisingly friendly.

Remember, we’re a marketing development agency so we develop your in-house marketing skills while we help you grow your business.