Brand attributes help sales

This is a demo version of one of our web pages. We created it for the marketing automation demonstration. The real version of the page is here.

What Are Brand Attributes?

Brand attributes are the characteristics people associate with your brand. In a business to business environment, positive brand attributes could be “expert”, “good value” or “understands our industry”. Negative brand attributes could be “overpriced”, “incompetent” or “slow”.

Do brand attributes help sales?

Brand attributes have a strong effect on your commercial performance and competitiveness. Let’s demonstrate that with a very simple analogy.

Imagine there’s a buyer looking for a blue car. At the same time, there are three sellers with, respectively, a red car, a blue car and a black car. It’s easy to understand that the seller with the blue car has a better chance of making a sale. He’s selling what the buyer’s interested in. He’s more likely to get the price he wants and he’s more likely to conclude the deal quickly.

Now imagine that the purchaser is looking for a brand attribute instead of a colour of car. It’s not as far-fetched as you would think:

- A business that’s already been burned by supplier that didn’t know what they were doing would now be looking for an expert supplier.

- A high-tech business might want to work with another technical leader.

- A start-up business with limited capital behind it would be looking for a low-cost supplier.

- A company with an urgent project to complete would be looking for a supplier that works quickly.

- A business that’s still in the process of developing its product portfolio might want a flexible supplier.

If your research already tells you that you’re considered to be expert, a technical leader, low-cost, fast or flexible you’re in a strong position to be the supplier to one of those companies. And if you’ve researched the prospects you’re speaking to, you know exactly which brand attribute they’re likely to cherish. You know how to promote yourself.

Attributes or aspirations?

The temptation is to claim brand attributes before you know you actually have them. Remember, in these days of brand democracy, you don’t control your brand attributes. The market tells you what they are.

It’s easy (but wrong) to promote the brand attributes we dream of rather than the ones the world says we have.

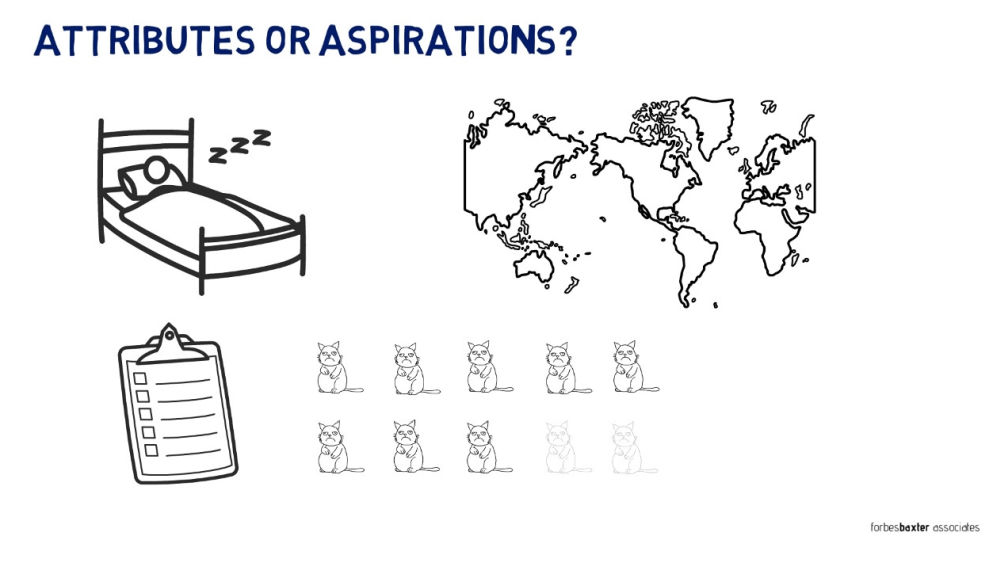

What many businesses try to do is promote positive brand attributes that they hope they have without any evidence that their customers agree. In many years of marketing, we can’t think of any business that didn’t want to say it delivered good service. Despite the fact that some of them patently didn’t.

If you’ve conducted a brand attributes survey, you can claim your brand attributes with evidence and authority. You can apply the “eight out of ten cats preferred…” treatment. You can promote the fact that 82% of your customers consider you an expert. Competitors without a brand attributes survey can only make spurious claims to the same virtue.

Which brand attributes should you pursue?

Your target market will dictate which brand attributes are the most valuable.

- If, for example, you sell a premium product to a niche market it’s unlikely that you need to worry about “inexpensive”. On the other hand, every brand would want to be seen as “good value”.

- If you’re an engineering company that supplies components to manufacturers, you would need to be able to demonstrate your compatibility: your technical skills and ability to integrate with your customers.

- If you’re a PR agency, you’d need to be able to demonstrate how well-connected you were with leading figures in the media.

- If you’re an artist or creative developer, your brand attributes might follow your style: impressionist, modern, abstract, et cetera.

Your goal will be to develop a blend of brand attributes, some of which are specific to your industry and some of which would be valued in all industries (good value, expertise, flexibility, et cetera).

There are two other properties that underpin the brand attributes you might want to pursue: value and exclusivity.

- Value: if the brand attribute is going to support your sales operations, it has to be valued by your customers. A software development house would need to be able to show it’s considered expert and skilled. Its dedication to environmental issues might not be valued or relevant. On the other hand, your charitable activities may not have been an attribute a prospective customer was looking for but they might be so inspirational that they draw the customer to you nevertheless. Value comes in different shapes and sizes.

- Exclusivity: a valuable brand attribute is one that your competitors can’t claim or mimic. A common complaint about suppliers in all markets is that they don’t understand their customers’ business. If you can demonstrate empathy and industry knowledge you can claim a fairly exclusive brand attribute.

How do you discover your brand attributes?

There’s only one way to find out what your brand attributes truly are: conduct a brand attributes survey. It’ll have two stages:

Qualitative research

The first stage of a brand attributes survey is the qualitative research. This consists of a series of interviews. For SMEs it could be fewer than ten. The goal is to ask open questions about the way customers see you. The topics you choose depend on the business areas that matter to you:

- A bank might focus on security.

- A law firm might need to know about confidentiality.

- A consultant might care most about expertise.

- A telecoms company might live and breathe customer service.

Once the interviews are complete, the answers need to be collated. Synonyms would be grouped together so, for example, “adept”, “experienced”, and “highly-skilled” would all be grouped under “expert”.

If you have fewer than 50 customers, a qualitative survey of 10 would satisfy the quick route to a brand attributes survey. At that point, you could compile a brand attributes report. However, we have to acknowledge that this wouldn’t satisfy a strict statistical definition of an adequate sample size. It would just give you a reasonable estimation of your brand attributes.

The other problem with relying on the qualitative part of the survey is that the interviewees were self-selected. It’s easy to ‘forget’ lost customers or almost customers. It’s human nature to be drawn to good customers who are likely to suggest positive attributes. A mechanism needs to be put in place to randomise the selection of interviewees.

The qualitative stage is absolutely essential. If you skip it, the questions you ask in the subsequent quantitative stage will be wrong.

- Imagine you’re Bertie Bott and you’re wondering which is the most popular of your Every Flavoured Beans. If you did quantitative research that just asked people how likely they’d be to recommend the bogie flavoured, earwax flavoured or athlete’s foot flavoured beans, you might get a result that said the earwax flavoured bean was the most popular one you produced.

That would obviously be wrong because you didn’t give people the chance to choose the nice flavours like ambrosia, ice cream and peanut butter. In the real world, it’s qualitative research that tells you which questions to ask when you do your quantitative research. - Mark Ritson has a somewhat more colourful way of showing the importance of qualitative research. At the beginning of his courses he asks delegates if they would like him to present in Speedos or stark bollock naked. Funnily enough, they all choose Speedos. We wouldn’t want to cast aspersions on his physical attractiveness, but we can only assume that they would have chosen fully-clothed had it been an option.

Quantitative research

Once you know the brand attributes you want to test, you need to survey a larger number of current, lost and almost customers to measure whether they agree that those attributes describe your brand.

The number of responses you need is calculated using one of the many sample size calculators available online. Once you tell it the confidence level you want (95%), the margin of error (10) and the population (the sum of your current, lost and almost customers), it tells us how many responses you need.

The results can be gathered by email. A phone survey can be used as a follow-up if you’re short of responses.

The questions would follow a standard Likert scale format:

“On a scale from 1 (strongly disagree) to 5 (strongly agree), would you describe our support as expert?”

Depending on the attribute, Likert scales can also be used to measure:

- frequency (always to never),

- importance (very important to unimportant),

- quality (very good to very poor) and

- likelihood (definitely to definitely not).

The importance measure is worth noting because the brand attributes you care about are ones that affect buying decisions. If your sample strongly agrees that your pricing is high, that seems bad. But if they also strongly disagree that price is an important selection criteria, it’s not so bad.

The End Result

Once you’ve completed your market attributes research you’ll be in one of two positions:

- The research confirms that you have strong, positive brand attributes. It gives you statistics you can promote. You have your “8 out of 10 cats” data.

- The research shows that you don’t have strong, positive brand attributes. There are two different scenarios here:

- You could be associated with positive brand attributes but only weakly i.e. customers agree you are “expert” but you only get to 3 or 4 on the Likert scale.

- Alternatively, you could have strong brand attributes but negative ones i.e. customers strongly disagree with the statement that you’re “good value”.

A brand attributes survey gives you ‘8 out of 10 cats’ data to support sales – or tells you what to improve.

The beauty of a brand attributes survey is that all the results are useful.

If you do have the strong, positive brand attributes you desire, you have some great data to support your marketing. You have the kind of data that most of your competitors lack.

But less positive results are incredibly useful too. If you didn’t do this research, how would you know if there were deficiencies in your customer care offering? It’s no use relying on internal metrics and gut instincts. The only opinions and the only metrics that matter are the ones that come from customers.

How long do brand attributes take to develop?

What’s probably obvious by now is that developing brand attributes is a long-term commitment. It takes years, not weeks.

Look on their development as a three stage process:

- identify valued attributes, then

- develop the product or service that delivers the attributes, and

- have the market recognise the attributes.

You’ll realise that you have to be consistent in your pursuit of attributes if you want to benefit from them. If service excellence is an attribute you’re seeking, you can’t afford to employ staff who knock off at 5 o’clock regardless of whether the customer’s happy. Your commitment to that brand attribute has to extend through every other person in the business. Furthermore, you have to put the resources (and money) behind your goal. If you expect people to take a service call even though it’s after their going home time, you’ve got to reward them appropriately.

Do you already know your brand attributes?

You may think so but, no, you don’t. Let me use another analogy.

Listen to a recording of your own voice. What did you think of it? 99% of us say something like “Do I really sound like that?” If you think about it, that’s truly bizarre. How could we not know how our own voices sound? We use them every day.

The truth is that it’s impossible to tell how the outside world hears us from inside our own heads.

The same applies to brand attributes. You have to ask the outside world what they are. Theirs are the only opinions that matter.

This is where you don’t want to be…

Here’s a little addendum to the original article.

Marketing Week published an interview with BT’s marcomms director about its brand troubles. He came up with this frightening quote:

“Most important is for us to stand for something and for that to resonate with people because at the moment we stand for nothing. When you look at our brand attributes, at things like ‘technology’, ‘trust’, ‘price’ and ‘service’ we are a fairly nondescript blob in the middle that doesn’t particularly spike in any of those things.”

Ouch.

That was a nasty position to be in but he did have the advantage of data that showed the weak points in BT’s brand attributes. If it hadn’t researched them, it wouldn’t even have known where to start.